Global Economic Outlook

The impact of the novel coronavirus pandemic has extended over more than a quarter. While Asian and some European countries appear to be stabilizing, the situation elsewhere in places such as the United States, Brazil, Russia, India, and Africa, are not experiencing much improvement. A second wave of infections has erupted as many countries were too eager to restart their economies, leading to circumstances that are un- likely to improve without the emergence of a vaccine.

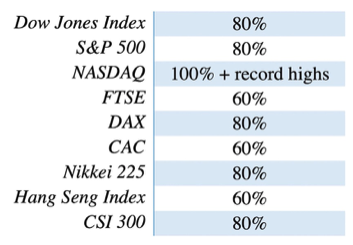

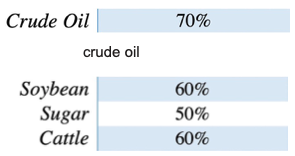

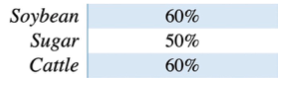

With the circulation of goods and resources inhibited by strict quarantine policies and international travel restrictions, corporate profits are not expected to perform well this year. While there may be some recovery on some aspects, profitability will be far less than levels prior to the virus outbreak. However, the financial markets reflect a different story. After the market crash that took place in March 2020, most asset classes have made a substantial recovery, as of June 30th 2020 (see charts below). With the stimulation of unlimited quantitative easing and ultra-low interest rates, many markets have displayed aggressive recoveries. Thus, it can be seen that the current stock markets do not reflect the actual economic situation and is instead dictated by capital flows and speculation.

Global Stock market rebound

crude oil

commodities

Precious metals

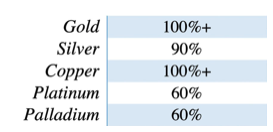

The recently reported low bond yields in conjunction with ultra-low interest rates have encouraged borrow- ing. Over the past ten years following the 2008 financial crisis, currency inflation has been of little concern to people in Asia and Europe. However, the latest monetary policies have introduced an excess of liquidity circulating in the economy which will eventually lead to the buying-up of scarce assets, forcibly propping up asset prices. Since the economy has not fully recovered and corporate profits cannot justify market values, any unexpected market movements may trigger drastic changes as the market adjusts to better represent true asset values. However, the cash from liquidating one asset must eventually flow into another asset, contrib- uting to near-term market volatility. During such turbulent times, asset allocation is crucial for anyone who wishes to protect from losses due to market fluctuations.

Whisky Market

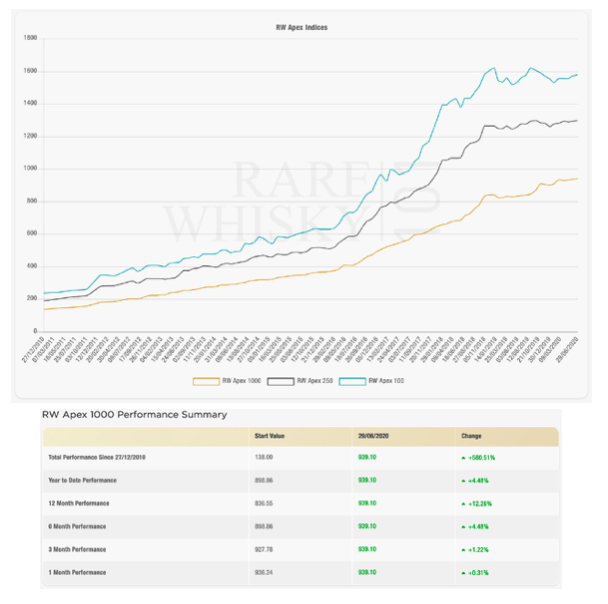

Source: Rare Whisky 101

In contrast to the stock market in March 2020, the whisky market has been relatively stable. While stock pric- es have plummeted, whisky prices did not undergo any substantial ups or downs. Overall, the whisky market has grown about 4.48% in the first half of 2020, with performances varying between distilleries and vintages. At the time of writing, distilleries are still closed in Scotland which marks the fourth month of zero produc- tion and no bottles filled. With a general lack of automation in the production processes and aging industry workforce (average age of 55 years), it is infeasible for the industry to make up for the lost whisky production. As a result of such shortages in the 2020 production cycle, the price of whisky will likely rise. When liquidity begins to flow into the market, whisky as an investment asset looks optimistic for the second half of the year.

Whisky Market News

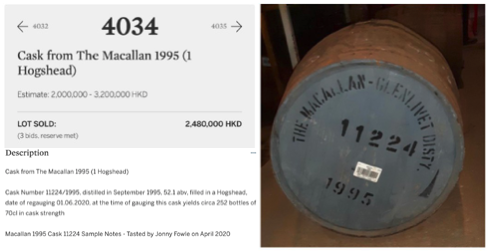

A 1995 Macallan cask sold for HK$2.48 million according to the Sotheby’s auction results on June 23rd, 2020. With reference to this result, Macallan casks belonging to the fund of a similar vintage and finish have poten- tially appreciated up to 20%.

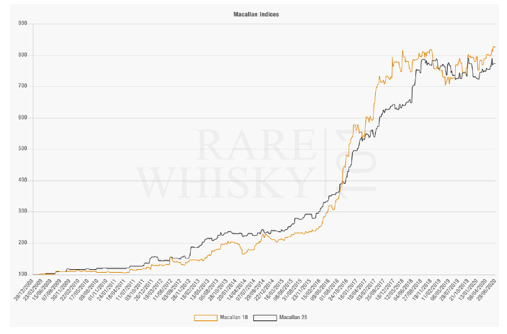

Source: Rare Whisky 101

The Macallan distillery is considered the standard by industry professionals, its market performance often serves as an indicator for the health of the whisky market. With the guidance of Investment Adviser, renowned whisky expert Mr Howard Cai, the fund is also able to capitalize on market opportunities. For instance, during a brief period of price decline in January 2020, the fund successfully expanded its inventory.

Due to intense demand, Macallan casks have not been sold to the public since 1999. As a result, the existing Macallan casks on the market are increasingly difficult to acquire, giving the whisky its exceptional price per- formance.

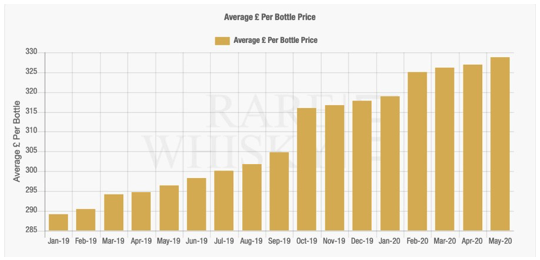

According to the bar chart above, the average price of whisky bottles have been steadily rising since the bull market earlier this year, through the novel coronavirus outbreak. Although there may be emerging distiller- ies in Scotland, the industry cannot compensate for the loss in productivity from the past year. While some may say production capacity can be boosted to meet the increasing demand, this is not the case due to the nature of production. In this situation, the only solution for distilleries is to shorten the maturing period and no longer display the vintage. For example, distilleries that have traditionally released 12-year matured whiskies into the market may choose to release 8 or 10-year product instead. Furthermore, the product is not legally recognized as whisky unless it has been aged for at least 3 years. Evidently, the production of whisky is not as straightforward as its counterparts, such as wines. In contrast, wines can be harvested annually and sold immediately to cover operating costs. Altogether, limited production capacity and labour costs also add to the difficulty in expansion for established whisky distilleries. This imbalance in supply and demand will have a prolonged impact on the pricing of higher vintage barrels.

International whisky news outlet Whisky Intelligence reports on Investment Advisor Mr Howard Cai’s in- volvement in the fund. Notably, the report highlights Mr Cai as the man behind the first independent single malt whisky bottling company in China. The press release further explains how Mr Cai has successfully en- tered the greater China market by offering his collection of unique whiskies and helping Chinese wine lovers discover a whole a new realm of tastes.

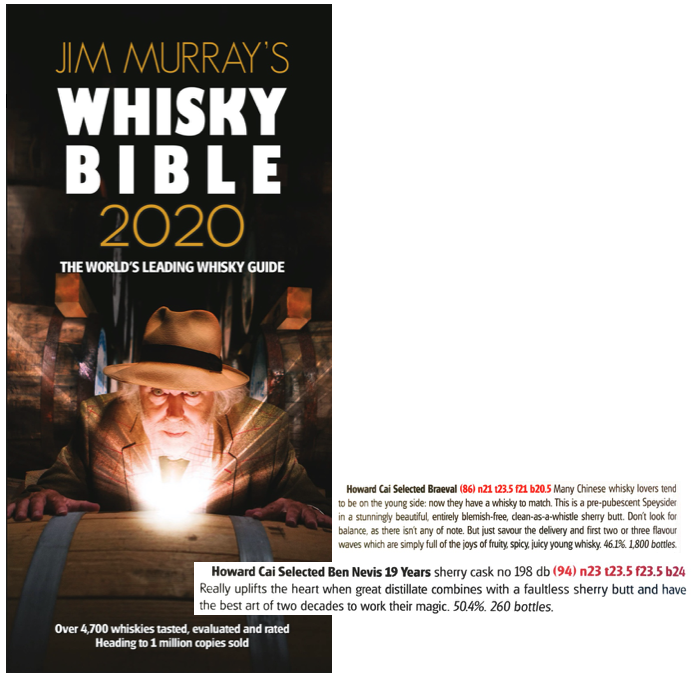

“85-89.5: very good to excellent whiskies, definitely worth buying”

“94-97.5: Superstar whiskies that give us all a reason to live”

In his 2020 edition of the world-famous “Whisky Bible”, Jim Murray commended two of Howard Cai Selected Whiskies, the “Howard Cai SelectedBraeval” (86 Points), and the “Howard Cai Selected Ben Nevis 19 Years” (94 Points). For reference, the two Howard Cai Selected bottles scored higher than Macallan’s notable original series, demonstrating the strict criteria under which the bottles are assessed and the distinction of which the bottles have achieved.