Original Post: https://tronblack.medium.com/ravencoin-assets-vs-erc-20-9ff1593c100d

When selecting a token technology, you should choose the technology that works best for your project.

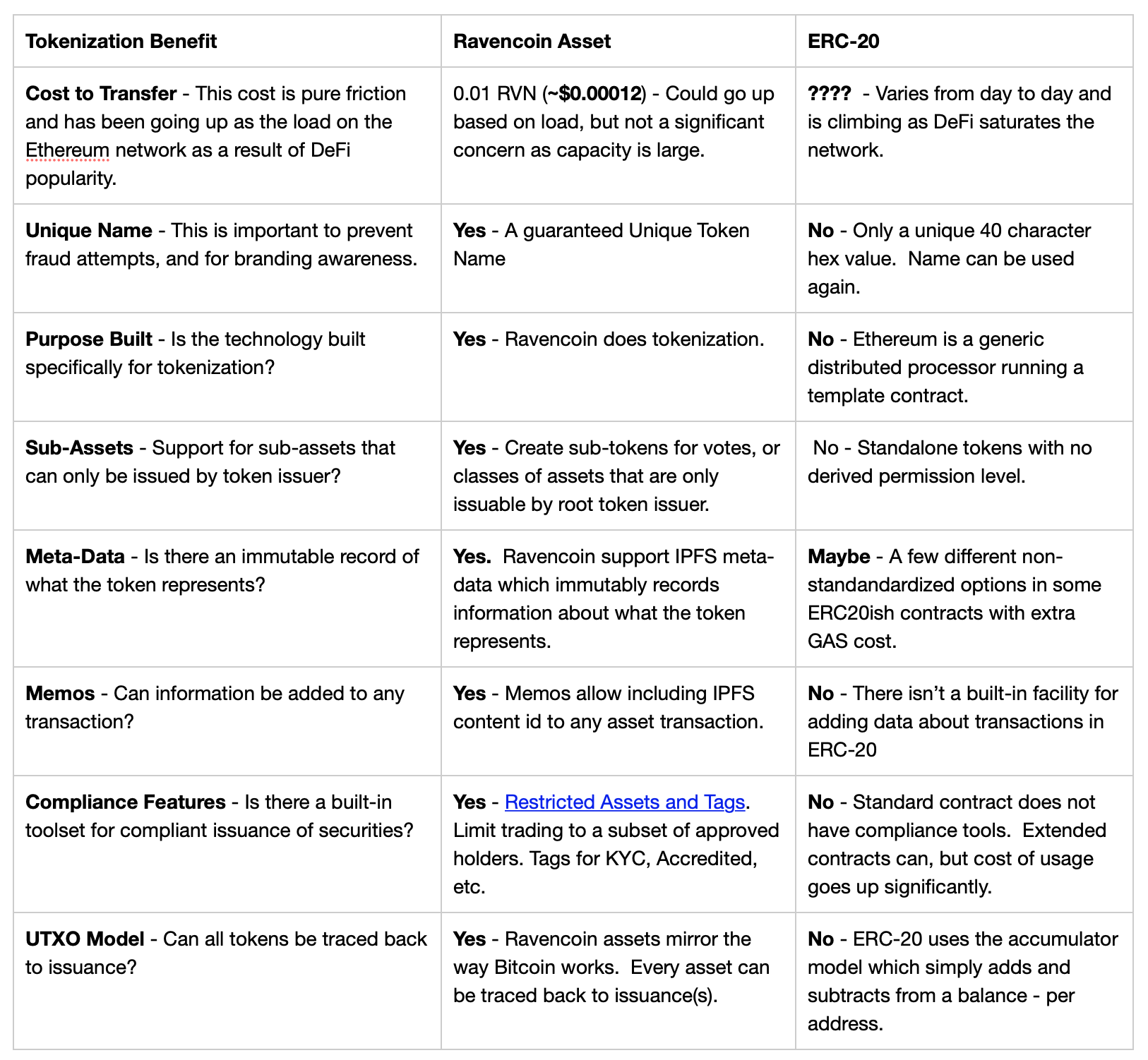

Cost to Transfer

The cost to transfer Ravencoin assets is much cheaper than ERC-20 or extended ERC-20 smart contracts. The cost varies by load on the Ethereum network, and the network is currently at a pretty high load because of the popularity of DeFi lending, trading, etc. If your token needs this DeFi network for its value, then you may want to bear this cost. But if your token is not dependent on the DeFi network which is mostly on Ethereum (currently), then Ravencoin assets transfer for a much lower cost.

The cost to transfer Ravencoin assets is minimal — as of this writing it under $0.0002 per transfer.

Unique Names — Anti-Spoofing

Having a unique name for your token is important for two reasons. First, is to prevent fraud and spoofing using identically named tokens. Just like we all know that IBM on NYSE market is a specific company. Imagine if there were 14 different stocks named IBM, and the only thing that distinguished the company formerly known as International Business Machines was a 40 character hex that looks like this: 0x04abeda201850ac0124161f037efd70c74ddc74d, but there are thirteen others that could look similar. It can lead to fraud as other contracts with a name of IBM masquerade as the real IBM.

Ravencoin takes the unique name to another level by using only uppercase letters, underscore, and . (dot), and then puts in some rules that the . (dot) and the underscore can’t be at the beginning or end of the token name, and you can’t include consecutive underscores, or dots. This is to reduce the incidences of fraudulent tokens. By using i (lowercase) and I (uppercase) in a token, you can make it look similar (with most fonts). For example: IBM looks similar to iBM. The lowercase letters are excluded from token names. Note: Unique Assets (NFTs) have an expanded character set after the # which includes lowercase letters and symbols which can be mapped to serial numbers, and real-life assets.

Unique Names — Branding

The second reason that a guaranteed unique name is valuable to token issuers is that the brand can be built using the name. Your name is included in Ravencoin asset browsers. Also, once trust is built in your root token name, then all sub-tokens can be trusted. This can be used by token issuance platforms that issue sub-tokens. For example: Let’s say TIP build their brand for [T]oken [I]ssuance [P]latform. Then you’d know that all sub-tokens like TIP/GREATCOMPANY and TIP/PROPERTY_DEAL are issued by the root token holder that owns TIP!

The TIRC token being used for the Tinaga Island Resort project cannot be counterfeited on the Ravencoin blockchain, so it can safely be used for branding without the concern of someone creating a token with the same name. This is not the case for ERC-20 where the only the 40-character contract id is unique, and where branding the token name could be risky.

Purpose Built

Ravencoin asset issuance platform is purpose built for asset issuance. So much so, that the core software that anyone can download for free has a built-in user interface for creating assets. The core software also has RPC calls to create and transfer assets so it can programmed or scripted for full automation.

These RPC calls, or API calls can be used to link the Ravencoin asset platform to issuance platforms, custodial platforms, exchanges, and transfer agent platforms of partners to build a complete STO ecosystem.

Ethereum, by contrast, runs a generic virtual machine, and the ERC-20 contract is just a template smart contract (program) that can be used to issue and transfer assets. The name of this instance of the ERC-20 contract is the 40 character name referenced above as the identifier of the token. The higher cost of operation is because the virtual machine of every computer runs the ERC-20 contract to effect every balance change.

Sub-Assets

Ravencoin has the concept of sub-assets, and these assets can only be created by the owner of the root asset. These sub-assets can be used for voting, or for trusted tokens that can be used for any purpose. Only the owner of the root asset can create these sub-asset tokens. ERC-20 tokens do not have the concept of ownership, or sub-assets unless the contract is extended, which adds to its cost of operation, and reduces its standardization.

Meta-Data

One challenge with assets is knowing the commitment or promise behind the token. This can lead to fraud if the promise of the token is separated from the token itself.

Ravencoin assets can be created with an IPFS content id that is embedded into the blockchain. Because of the way IPFS works to reference the file information with the hash (content id), it makes it impossible to edit the meta-data associate with the Ravencoin asset. This information is standardized and available through various Ravencoin asset explorers. The meta-data can be PDFs, movies, text files, or even entire folders or websites that convey the meaning and purpose of the issued asset.

For the Tinaga Island Resort project, the Ravencoin asset technology allows linking the TIRC token to the documents about the offering, and about the island property.

Because Ethereum smart contracts are programs, it is possible modify the contract to add meta-data in a non-standard way, and some non-standard contracts have done so. Since it isn’t in the standardized smart contract, it isn’t exposed via standard explorers.

Memos

Memos in Ravencoin are immutable IPFS data added to any transaction. This extra data can be used by the issuer to link initial issuances back to internal records, to publicly record cost-basis information, record ‘rule 144’ restrictions, include information about legal status, include details of rewards or dividends, or mark transactions as required.

Compliance Features

A special type of token on the Ravencoin platform helps issuers stay compliant with the rules and regulations of some jurisdictions. The combo of Restricted Assets and Tags provides a powerful set of tools that can keep assets moving in a smaller subset of pre-cleared (tagged) addresses. In some cases, the address owner must be checked under KYC (Know Your Customer) rules. Sometimes, only accredited users can hold the tokens. Tags allow issuers to tag addresses that have complied, and Restricted Assets will honor these tags when transferring. The issuer decides which tags are needed, and sets the rules for the Restricted Assets, and can change them as needed. Ravencoin isn’t aware of any rules, but gives the tools to issuers to comply with any rules for any jurisdiction.

For the Tinaga Island Resort project, this would allow the issuer to stay compliant and still issue the tokens by requiring holders to have a #KYC tag on their Ravencoin address.

Since Ethereum is just a virtual machine and programming language, this can be done, but most attempts at doing compliance through whitelisting addresses have made token transfers very expensive because of the extra processing needed combined with the growing GAS cost of using the Ethereum network.

UTXO Model

This may or may not be helpful for every project, but there is additional tracking of assets in Ravencoin because it stores all UTXO (Unspent Transaction Outputs). Every transaction (issuance and transfer) is stored in its own digitally signed transaction. The sum of these UTXOs for an address is the address balance, and the sum of all UTXOs for all addresses for an asset will always match the issuance plus re-issuances and so all assets can be audited with an open-source script.

Summary

Ravencoin assets are objectively better for almost every use-case than ERC-20 where interaction with DeFi isn’t necessary or desired. For some use-cases, like STOs, involving securities, using ERC-20 can be legally dangerous for the issuer as the ease of violating secondary market rules with DeFi can put the issuer in a legally risky grey area.