BTC 24 Hr High $11,855

BTC 24 Hr Low $11,232

BTC + 1.1%

Traditional markets:

- Recovery. U.S. retail sales rose 1.2% in July, marking the third consecutive monthly gain, as shopping surpassed pre-pandemic levels. In the labour market, 963,000 unemployment claims were filed in the latest weekly count, ending a string of 20 consecutive weeks in which claims topped 1 million.

- Gold pulls back. After surging above $2,000 per ounce in the previous week, the price of gold retreated from that record level to around $1,950. Nevertheless, it’s been a strong run for gold, which was trading below $1,500 as recently as March. In mid-July, it was at around $1,800.

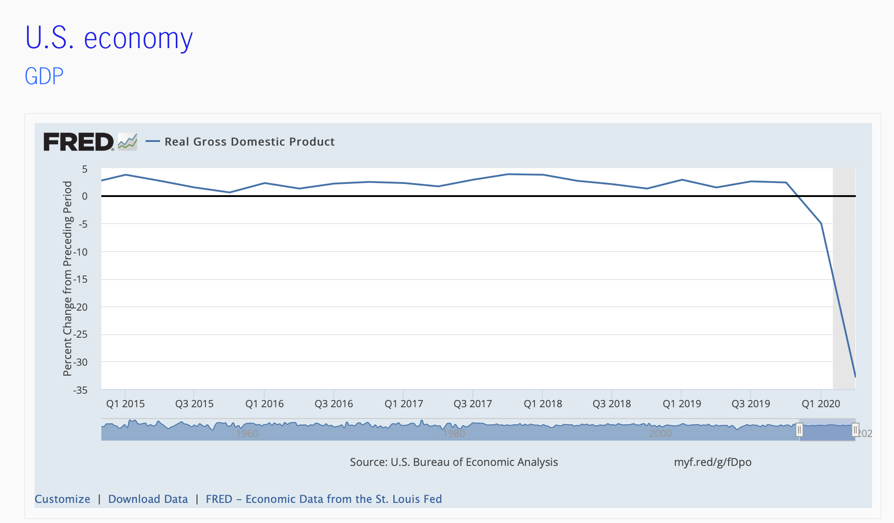

- Europe Eased. European stock indexes fell on Friday after the United Kingdom imposed a quarantine on travellers from France―a restriction aimed at slowing the spread of the coronavirus. Separately, the United Kingdom reported that second-quarter GDP plunged more than 20%.

- U.S.-China talks. As the week ended, U.S. and Chinese officials opened a new round of trade talks in the wake of rising tensions that have put investors on edge. Among other things, the two economic superpowers planned to evaluate China’s initial compliance with a bilateral trade agreement signed in January.

- Bond sell-off. After sinking as low as 0.55% in the previous week, the yield of the 10-year U.S. Treasury bond topped 0.70% on Thursday for the first time in nearly two months. U.S. government bonds came under selling pressure after a $38 billion auction of new 10-year notes.

We end the week with the largest circulating story surrounding YAMs (yam.finance) DeFi token which tanked after it was revealed that an accidental omission in a line of code could lead to significant “Zimbabwe style” inflation (reference 1 USD = 362 ZWD). The coin effectively had lost control of its on-chain governance feature and to add salt to the wound, permanently locked $750,000 worth of Curve tokens. As we watch the DeFi markets heat up, this is a clear example of the implications if the projects rush the final release without a proper code audit to prevent this from happening.

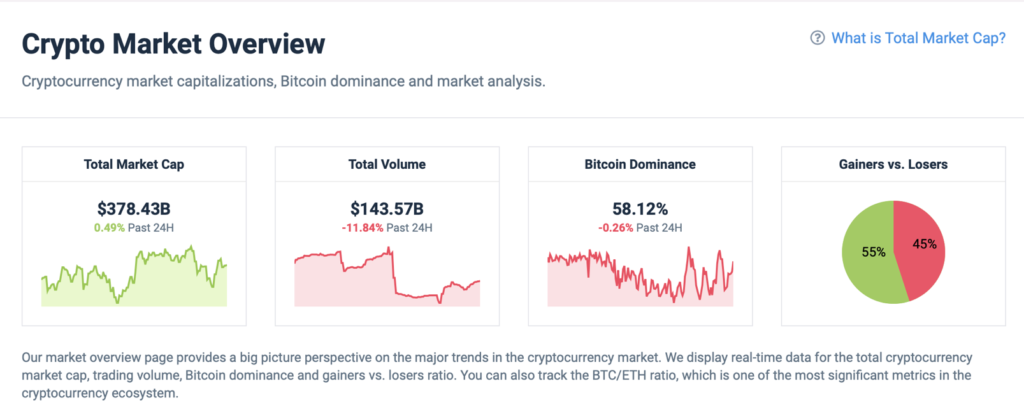

- Bulls are back in charge with all the top 10 large-cap coins in the green, digital asset market cap up 2.43% to 371B overnight with ETH surging $28 to reject 430 resistance and declined to be range bound between 416-425 with trading volumes decreasing after the push.

- All the on-chain activity from the sheer amount of ETH and DeFi-related volume being pushed through the ERC-20 chain, gas fees are now at all time highs for the past two days. Trading currently at neutral RSI levels

- BTC physical volumes up 4% to 27B as it maintains around 11,745 after rejecting 11,850 in the evening American trading session. 11k is the new 10k perhaps with it maintaining above 11,000 levels for 12 days straight, breaking its most recent streak between July 3-13 2019 for 10 days. The next target is to last 60 days which BTC traded above this level during the initial mainstream “adoption”.

- Support levels currently at 11,685, if it breaks this, the next support drops down to 11,490.

- Trading on upper Bollinger bands and trading $60 above its 10 day SMA. RSI indicators showing overbought levels but will need move volume to push past DeFi hype and challenge 12,000.

EDITORIAL

DeFi – Next Phase of the Crypto Evolution

A new wave in crypto has begun and its buzzword is DeFi

- which stands for decentralized finance. The idea of decentralized finance is that financial institutions can be created that are run by computers, blockchains and rules that anyone can access free of gaining permission or having to show trust or be trusted, and these cyber financial institutions run on a network of computers anywhere in the world along anarcho-capitalistic lines designed to resist outside interference.

This is now possible on smart contract blockchains, like Ethereum. “Smart contracts” are programs running on the blockchain that can execute automatically when certain conditions are met. These smart contracts enable developers to build far more sophisticated functionality than simply sending and receiving cryptocurrency. These programs are what we now call decentralized apps, or dapps.

You can think of a dapp as an app that is built on decentralized technology, rather than being built and controlled by a single, centralized entity or company. (Get used to this word, dapp, you’ll be seeing it a lot from here on out.)

While some of these concepts might sound futuristic– automated loans negotiated directly between two strangers in different parts of the world, without a bank in the middle– many of these dapps are already live today.

There are DeFi dapps that allow you to create stablecoins (cryptocurrency whose value is pegged to the US dollar), lend out money and earn interest on your crypto, take out a loan, exchange one asset for another, go long or short assets, and implement automated, advanced investment strategies.

What differentiates these DeFi dapps from their traditional bank or Wall Street counterparts?

- At their core, the operations of these businesses are not managed by an institution and its employees — instead the rules are written in code (or smart contract, as mentioned above). Once the smart contract is deployed to the blockchain, DeFi dapps can run themselves with little to no human intervention (although in practice developers often do maintain the dapps with upgrades or bug fixes).

- The code is transparent on the blockchain for anyone to audit. This builds a different kind of trust with users, because anyone has the opportunity to understand the contract’s functionality or find bugs. All transaction activity is also public for anyone to view. While this may raise privacy questions, transactions are pseudonymous by default, i.e. not tied directly to your real-life identity.

DeFi is now one of the fastest growing sectors in crypto. Industry observers measure traction with a unique new metric — “ETH locked in DeFi”. At the time of writing, users have deposited over $600 million worth of crypto into these smart contracts.

Intrigued? Let’s take a closer look at just a few of the popular DeFi dapps out there that you can try today.

Stablecoin and Decentralized Bank – MakerDAO

Maker is a stablecoin project where each stablecoin (called DAI) is pegged to the US Dollar and is backed by collateral in the form of crypto. Stablecoins offer the programmability of crypto without the downside of volatility that you see with “traditional” cryptocurrencies like Bitcoin or Ethereum.

Crypto Finance: Compound

Compound is a blockchain-based borrowing and lending dapp — you can lend your crypto out and earn interest on it. Or maybe you need some money to pay the rent or buy groceries, but your funds are tied up in your crypto investments? You can deposit your crypto to the Compound smart contract as collateral, and borrow against it. The Compound contract automatically matches borrowers and lenders, and adjusts interest rates dynamically based on supply and demand.

Automated Token Exchange: Uniswap

Uniswap is a cryptocurrency exchange run entirely on smart contracts, letting you trade popular tokens directly from your wallet. This is different from an exchange like Coinbase, which stores your crypto for you and holds your private keys for safekeeping. Uniswap uses an innovative mechanism known as Automated Market Making to automatically settle trades near the market price. In addition to trading, any user can become a liquidity provider, by supplying crypto to the Uniswap contract and earning a share of the exchange fees. This is called “pooling”.

Sources/Reference

Kraken, OSL, coindesk, Deribit, CoinMarketCap, Coincodex,

John Hancock Investment, Efficient Frontier, The Block