BTC 24 Hr High $11,179

BTC 24 Hr Low $10,899

BTC + 0.06%

Traditional markets:

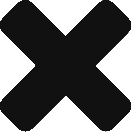

- Slight decline. The major U.S. stock indexes fell for the third week in a row, retreating again from the record highs that the S&P 500 and the NASDAQ achieved early this month. The latest week’s decline was much smaller than the previous week’s pullback.

- Near-zero rate outlook. The U.S. Federal Reserve kept interest rates unchanged and signalled that it expects to keep its benchmark rate near zero for at least three more years. All 17 Fed officials who made projections said they expect to keep rates near zero at least through next year, and 13 projected rates would stay there through 2023.

- Oil recovery. After two weeks of declines, U.S. crude oil prices recovered ground, climbing back to around $41 per barrel. Much of the week’s gain came on Wednesday, after the government reported that U.S. crude oil supplies fell to the lowest level in five months.

- Europe. Investors focused on negotiations over the EU’s proposed 750 billion-euro ($840 billion) program to help economies rebound from lockdowns, which helped send the Stoxx 600 Index up 0.6%.

- Asia. Nikkei 225 ended the day flat, in the green 0.18% as concerns about company earnings in the face of the coronavirus pandemic prompted investor caution.

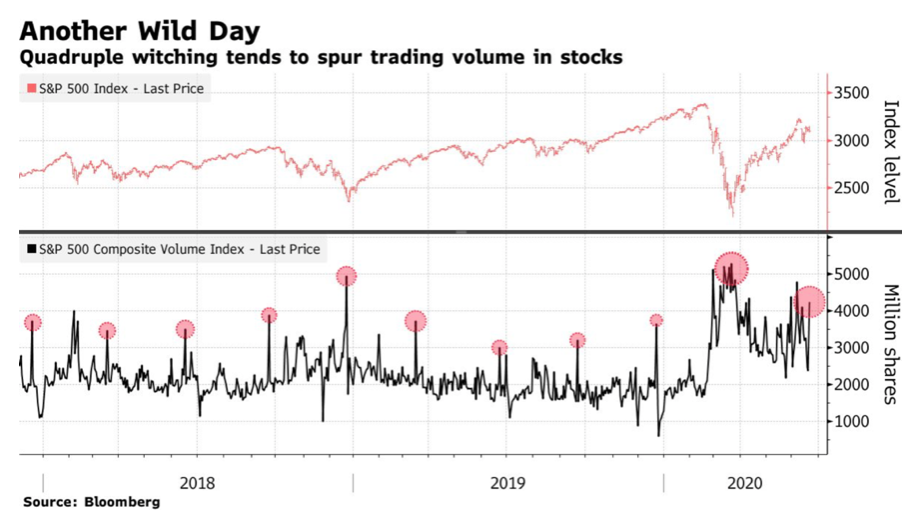

Bitcoin has lost its market momentum. Meanwhile, the amount of cryptocurrency locked in decentralized exchange Uniswap was nearly doubled on Friday.

- Bitcoin (BTC) trading around $10,867 as of 20:00 UTC (4 p.m. ET). Slipping 0.42% over the previous 24 hours.

- Bitcoin’s 24-hour range: $10,812-$11,039

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

Bitcoin was only able to eclipse the $11,000 level briefly Friday before dropping to as low as $10,812 on spot exchanges such as Coinbase.

Markets are looking weak on drying-up liquidity on exchanges while BTC hardly managed to reach back above the $11,000 level and couldn’t sustain it,” said Jean Baptiste Pavageau, partner at trading firm ExoAlpha.

Indeed, major USD/BTC exchange volumes are looking feeble, with Friday tallying a $211 million total so far while daily averages the past month have been $364 million.

Rupert Douglas, head of institutional sales at crypto brokerage Koine, is concerned stock markets are in for a correction, potentially hurting crypto as investors look to unload risky assets.

“I think equities are headed lower and if that happens digital assets will get sucked down, too,” Douglas told CoinDesk. “The tech shares are too frothy,” he added

Philip Tam

Co-founder & CEO

Sources/Reference

Kraken, OSL, coindesk, Deribit, CoinMarketCap, Coincodex, Binance

John Hancock Investment, Bloomberg